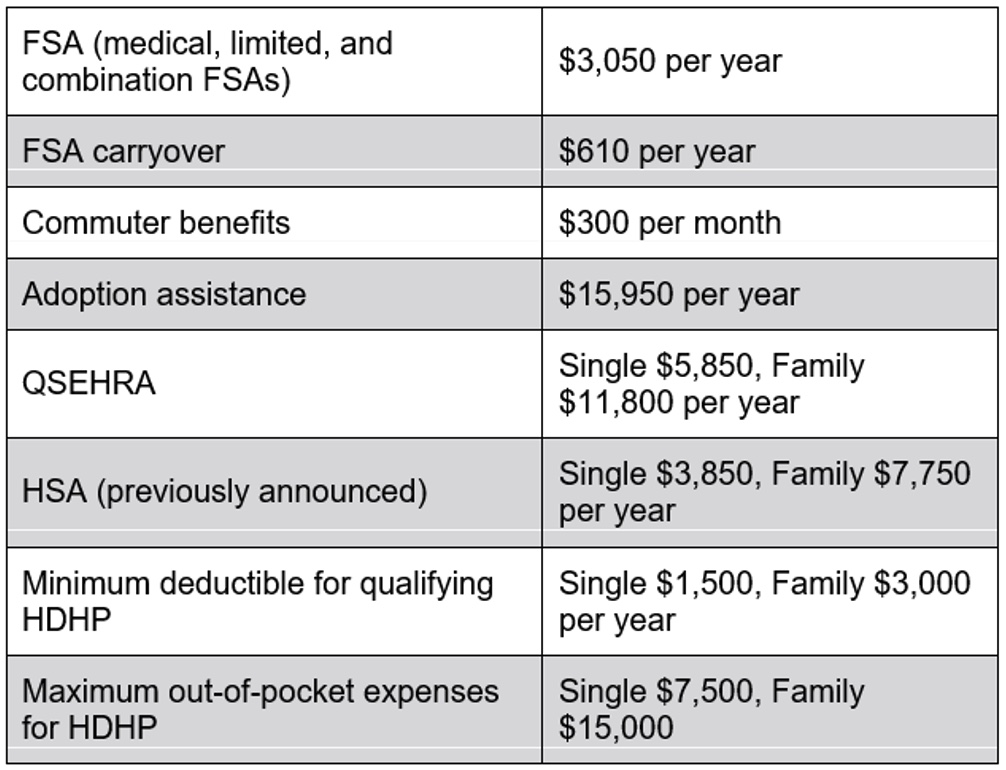

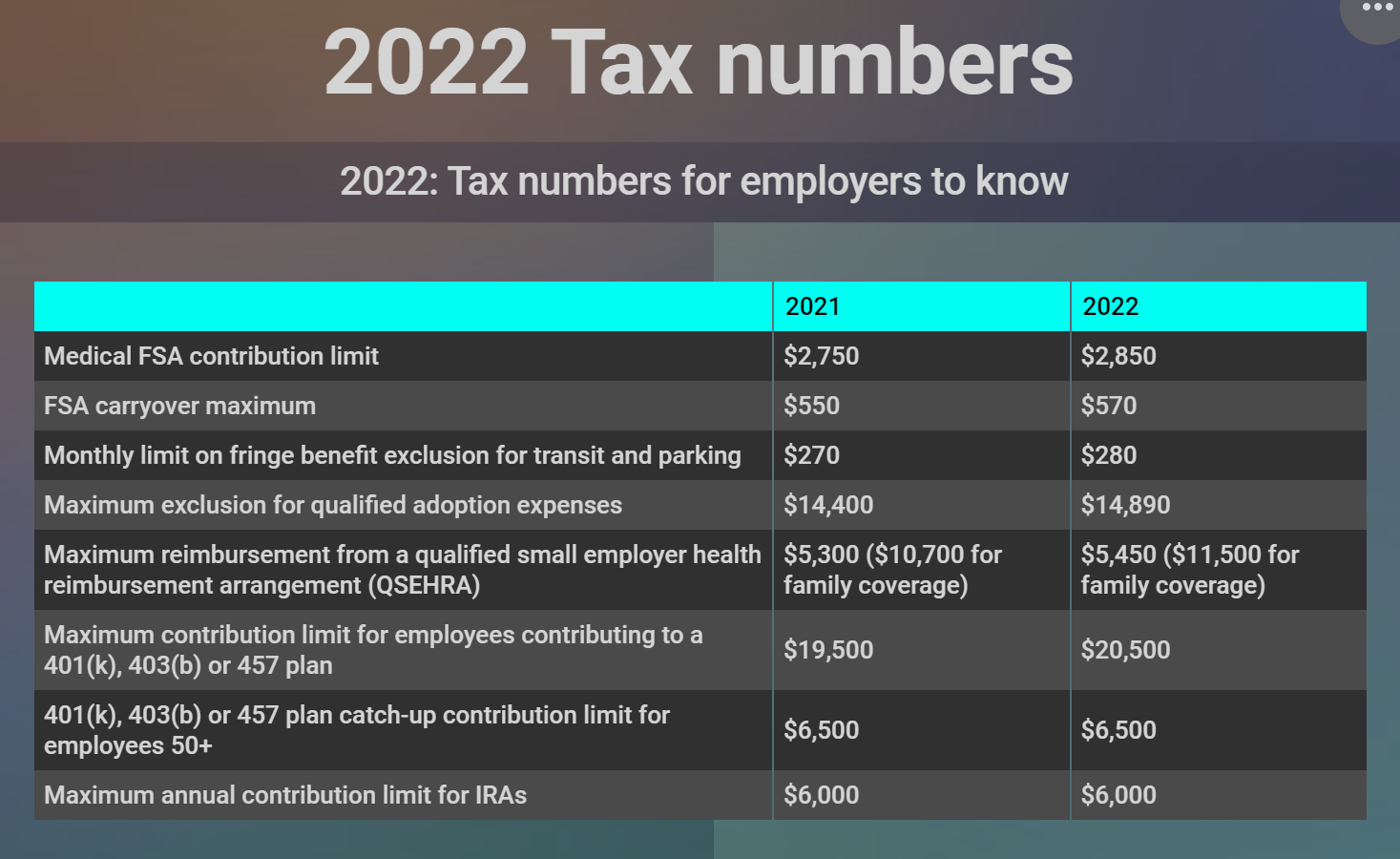

Fsa Limits 2024 Irs. On november 10, via rev. The irs limits fsa rollovers at $610 for 2023 and $640 in 2024.

Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover. In 2024, the fsa contribution limit is $3,200, or roughly $266 a month.

Fsa Limits 2024 Irs Images References :

Source: dollibelizabeth.pages.dev

Source: dollibelizabeth.pages.dev

Fsa 2024 Contribution Limit Irs Tonia Griselda, On november 10, via rev.

Source: frankymarcela.pages.dev

Source: frankymarcela.pages.dev

Dependent Care Fsa Limits 2024 Irs Penni Blakeley, $640 (for applicable plans) $610.

Source: genniferwstar.pages.dev

Source: genniferwstar.pages.dev

Irs Fsa Contribution Limits 2024 Paige Rosabelle, Plans that allow a carryover of unspent fsa funds can now permit up to $640 to rollover.

Source: correyymatilde.pages.dev

Source: correyymatilde.pages.dev

Irs Dependent Care Fsa Limits 2024 Natka Anastasia, The irs has just announced updated 2024 fsa contribution limits, which are seeing modest increases over 2023 amounts.

Source: karonazbethina.pages.dev

Source: karonazbethina.pages.dev

Dependent Care Fsa Limit 2024 2024 Lida Sheila, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024.

Source: dorianyletisha.pages.dev

Source: dorianyletisha.pages.dev

2024 Fsa Limits Irs Increase Corey Donella, Employers should take proactive steps to ensure compliance with the revised limits, communicate changes effectively, and provide employees with the necessary information to make informed.

Source: dannyeylenora.pages.dev

Source: dannyeylenora.pages.dev

Irs Fsa Contribution Limits 2024 Lanae Mabelle, For 2024, there is a $150 increase to the contribution.

Source: saritawarleta.pages.dev

Source: saritawarleta.pages.dev

Irs Fsa 2024 Limits Marna Sharity, 2024 flexible spending arrangement contribution limit rises by $150.

Source: liesaychristian.pages.dev

Source: liesaychristian.pages.dev

Fsa 2024 Irs Limit Valry Jacinthe, Here are the new 2024 limits compared to 2023:

Source: jeaneymarysa.pages.dev

Source: jeaneymarysa.pages.dev

2024 Dependent Care Fsa Contribution Limits And Kimmi Merline, But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Posted in 2024