King County Senior Property Tax Exemption 2024. You can apply for a property tax exemption for 2024, 2023, 2022 and 2021. Please note that you must meet the age, ownership,.

Mftes allow for tax breaks on property improvements for housing developments when certain requirements are met. First half property taxes are due april 30.

Find Out How To Qualify And Apply.

You will need to meet the following criteria:

Allows Continued Eligibility For The Senior Citizen, Disabled Individuals, And Qualifying Veterans' Property Tax Exemption If Income Exceeds The Threshold As The Result Of Certain Cost Of Living.

Click here to apply online , or apply by mail, download 2024 paper application and instructions.

While We Use The Irs Tax Return As A Tool To Help Determine Your Qualifying Income Level For The Exemptions Program, The Irs And Washington State.

Images References :

Source: www.cutmytaxes.com

Source: www.cutmytaxes.com

A Complete Guide on Property Tax Exemption Cut My Taxes, Click here to apply online , or apply by mail, download 2024 paper application and instructions. Many fear being priced out of private education if labour forces through its plans to scrap the 20 per cent tax exemption, after 76 per cent of schools surveyed said they would.

Source: www.formsbank.com

Source: www.formsbank.com

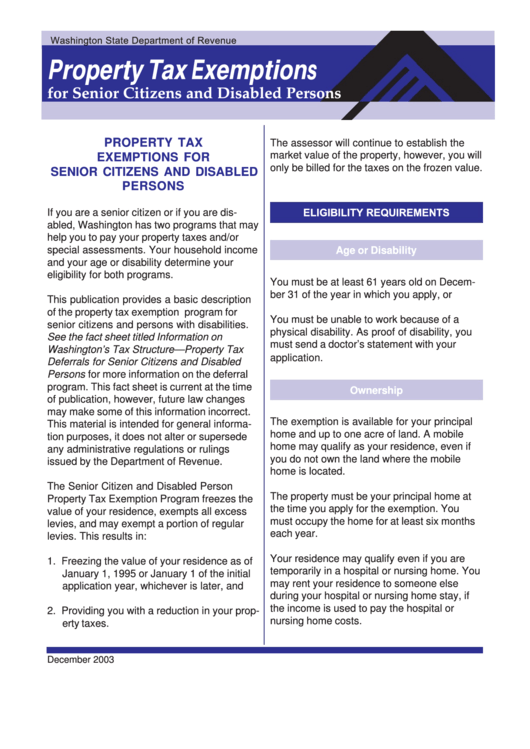

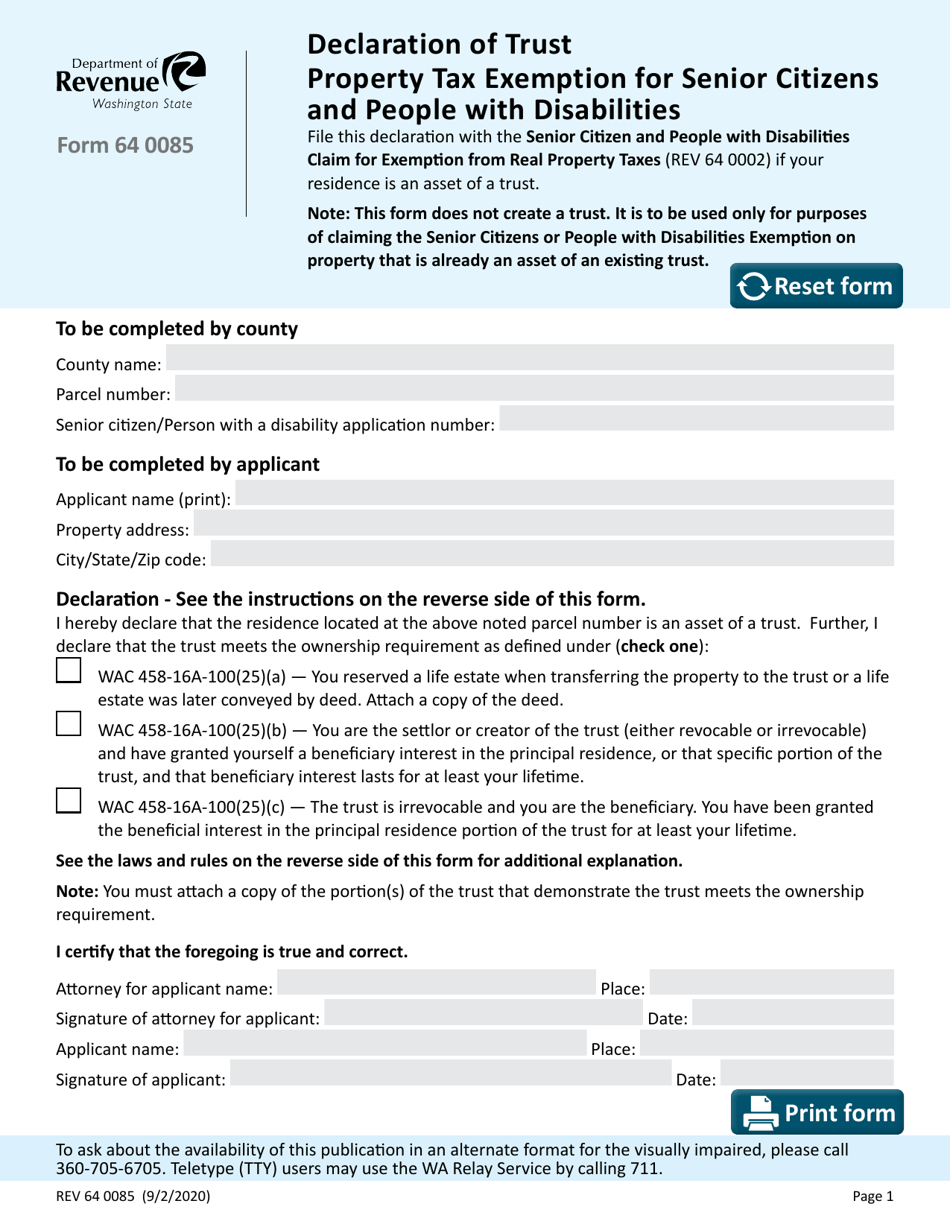

Property Tax Exemptions For Senior Citizens And Disabled Persons, We recommend applying online for faster service. “this bill means a savings on a typical $690,000 home.

Source: www.dochub.com

Source: www.dochub.com

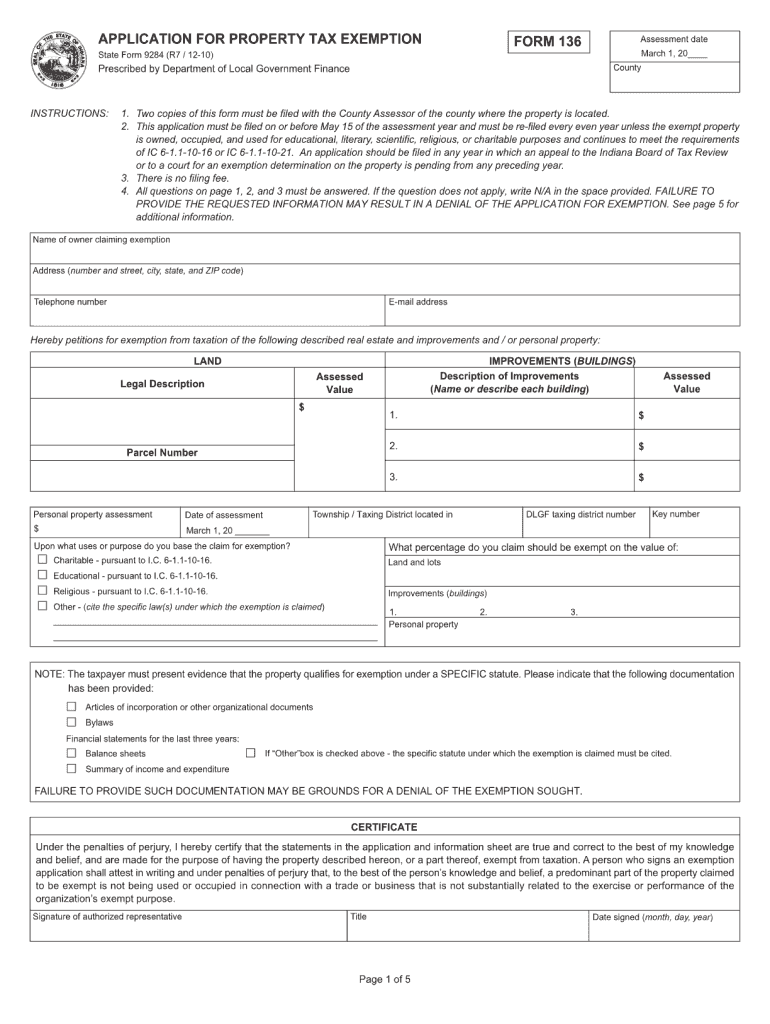

Form 136 Fill out & sign online DocHub, More older people and those with disabilities would qualify for property tax breaks under a state proposal to. You will need to fill out a separate application for each year.

Source: fabalabse.com

Source: fabalabse.com

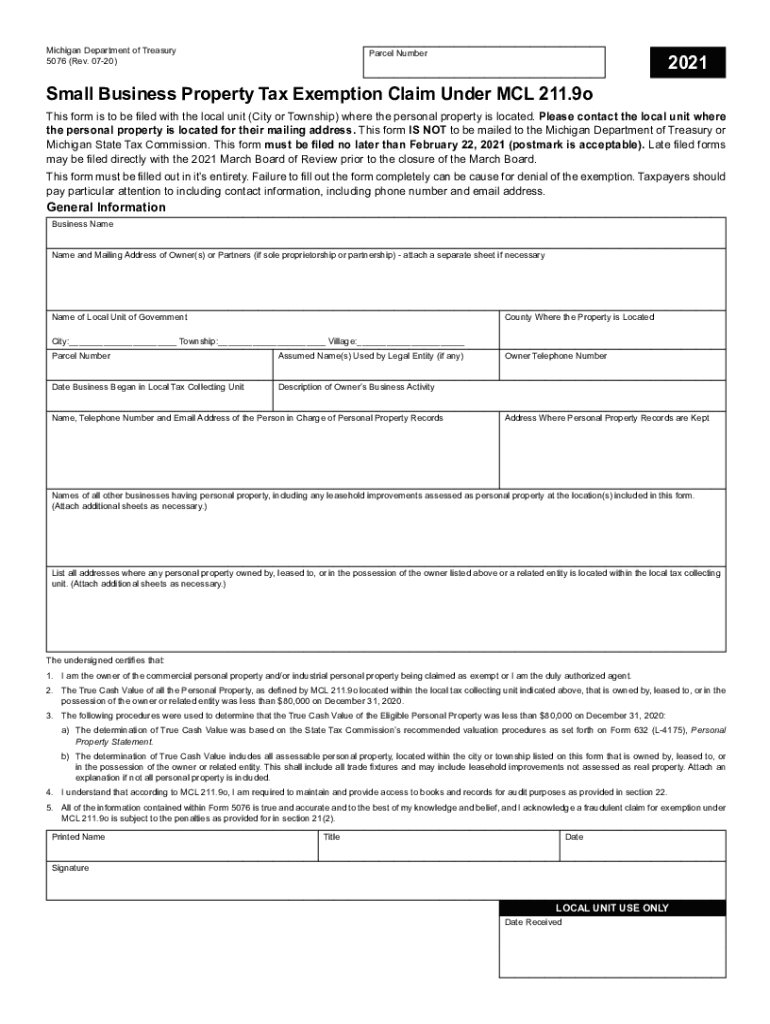

Who qualifies for property tax exemption in Michigan? Leia aqui At, Will need to meet the following criteria: Born in 1961 or earlier, or.

Source: www.pdffiller.com

Source: www.pdffiller.com

Il Senior Citizen Exemption Application Fill Online, Printable, You will need to fill out a separate application for each year. The claimant must have combined disposable income of $67,411 or less as defined for the senior citizen exemption in rcw 84.36.383, and must be at least 60 years old at time of filing or.

Source: prorfety.blogspot.com

Source: prorfety.blogspot.com

How To Apply For Senior Property Tax Exemption In California PRORFETY, An informative, free session on the king county senior and disabled persons property tax exemption program with john wilson, king county assessor will be held at the. In king county, this will raise the income eligibility level from roughly $58,000 per year to just over $72,000 per year.

Source: www.dochub.com

Source: www.dochub.com

Michigan veterans property tax exemption form Fill out & sign online, More older people and those with disabilities would qualify for property tax breaks under a state proposal to. To review current amounts due or pay your property tax bill, please use our safe and secure online ecommerce system.

Source: www.formsbank.com

Source: www.formsbank.com

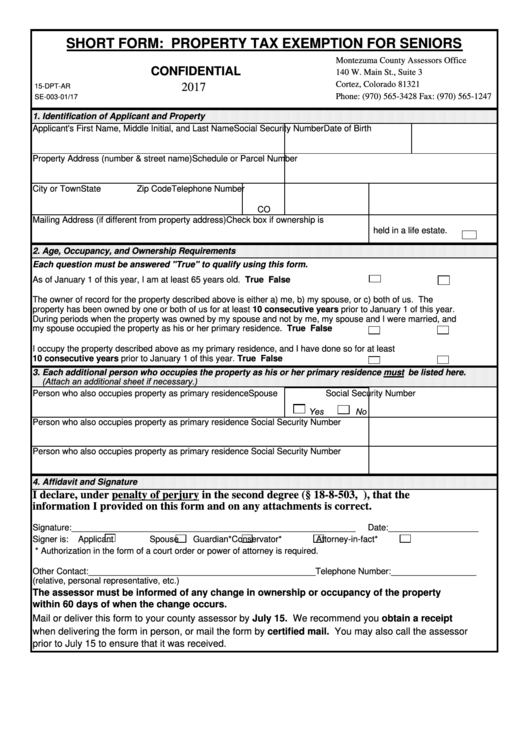

Fillable Short Form Property Tax Exemption For Seniors 2017, In washington, individuals who meet certain eligibility requirements may receive a. Property tax exemption for seniors, people retired due to disability, and veterans with disabilities.

Source: www.countyforms.com

Source: www.countyforms.com

Will County Senior Tax Freeze Form, The claimant must have combined disposable income of $67,411 or less as defined for the senior citizen exemption in rcw 84.36.383, and must be at least 60 years old at time of filing or. Washington state legislature in the 2019 session amended rcw 84.36.381 (via essb 5160) to increase property tax exemptions for total annual income from $40,447 or less to $58,423 or.

Source: ecover.mx

Source: ecover.mx

Top 50+ imagen senior citizen property tax discount Ecover.mx, Allows continued eligibility for the senior citizen, disabled individuals, and qualifying veterans' property tax exemption if income exceeds the threshold as the result of certain cost of living. Please note that you must meet the age, ownership,.

You Will Need To Meet The Following Criteria:

To review current amounts due or pay your property tax bill, please use our safe and secure online ecommerce system.

Please Note That You Must Meet The Age, Ownership,.

The soonest a homeowner could qualify under the new limits would be for 2024 taxes based on 2023 income, king county assessor john wilson said.